OUR PROCESS

Once a service provider is recruited and selected by the client, they are referred to TEAM. TEAM becomes the W-2 employer through a simple,

seamless enrollment process (online or paper) that is designed with a consultative approach to ensure continuity with current pay setups while adhering to the latest employment laws and regulations.

––––––

We keep our clients informed throughout the process, ensuring that your client receives top-notch service and that employees feel supported throughout the entire employment lifecycle.

––––––

We know that providing the best service involves real human connection, which is why we take pride in offering prompt, personalized service – no 800 numbers or automated bots.

COMMON QUESTIONS

One of the most common (yet easily avoidable) mistakes people make when hiring domestic employees is misclassifying them as independent contractors. It’s critical to note that neither you nor the worker themselves can make the determination about whether they are an employee or a contractor. There are various tests set forth by the IRS, Department of Labor, and your state or local labor commission to determine a worker’s classification, but generally, if the answer is “Yes” to any of the three following questions, the worker is likely a W-2 employee – not a 1099 independent contractor:

- Does the provider only work with your client (versus having multiple clients)?

- Does the provider not have their own professional liability insurance?

- Are you or your client making any regular disbursement (per diem, per session fees, salary, hourly rate, etc.) to an individual?

Absolutely – this is essential to our model as TEAM does not recruit, place, refer, or match workers on behalf of clients. Allowing families and individuals to have choice over who works in their homes not only allows for more flexibility to hire service providers they know and trust, but helps facilitate a positive experience for both the employer and employee.

The following list includes examples of common titles we employ. If you want to transition a household employee to TEAM but don’t see that person’s job title on this list, feel free to contact us and we are happy to help make the determination.

- Assistants and household or estate managers

- Bookkeepers

- Caregivers and companions, including family members

- Dog walkers

- Drivers

- Gardeners, landscapers, and groundskeepers

- Grant writers or other foundation employees

- Housekeepers

- Nannies

- Property managers

- Ranch hands and farm workers

- Security guards

- Tutors, teachers, and instructional assistants

We make the transition simple and seamless through a three-step hiring process:

- Client recruits and selects service provider, then refers them to TEAM for payroll and employment administration purposes.

- Client and the employee each complete an enrollment form.

- TEAM conducts a background check and employment eligibility verification, as part of our equitable hiring practices.

- TEAM becomes the employer of record. Clients continue to manage all day-to-day aspects, but employees gain added benefits such as reliable payroll processing, access to Social Security and Unemployment, dedicated payroll and HR support, and more.

TEAM processes payroll in-house five days a week, so we can accommodate a wide variety of pay schedules. TEAM will consult with you on the current pay setup to provide as much consistency as possible while ensuring compliance with wage and hour laws.

As the employer of record, TEAM puts in place internal and external risk management procedures, supported by a robust array of insurance policies designed for the protection of all parties including the employee, the individual or family they provide services for, and the financial institution that often acts as the intermediary. These policies include workers’ compensation; general liability and excess liability; EPLI (wrongful termination, discrimination, harassment, etc.); employee theft and crime; and other coverages.

We understand that change can be difficult, particularly with employment in a household environment. With that in mind, TEAM clients and employees have flexibility in how they choose to communicate the transition and utilize TEAM’s services. Most importantly, the core job duties and responsibilities of the employees will likely not change. Client will continue to manage all day-to-day aspects like they do today without involvement from TEAM. For some employees, the primary difference is that they now receive their paychecks and tax documents from TEAM. Other employees choose to interact with TEAM more regularly for payroll and other questions, or for general HR support.

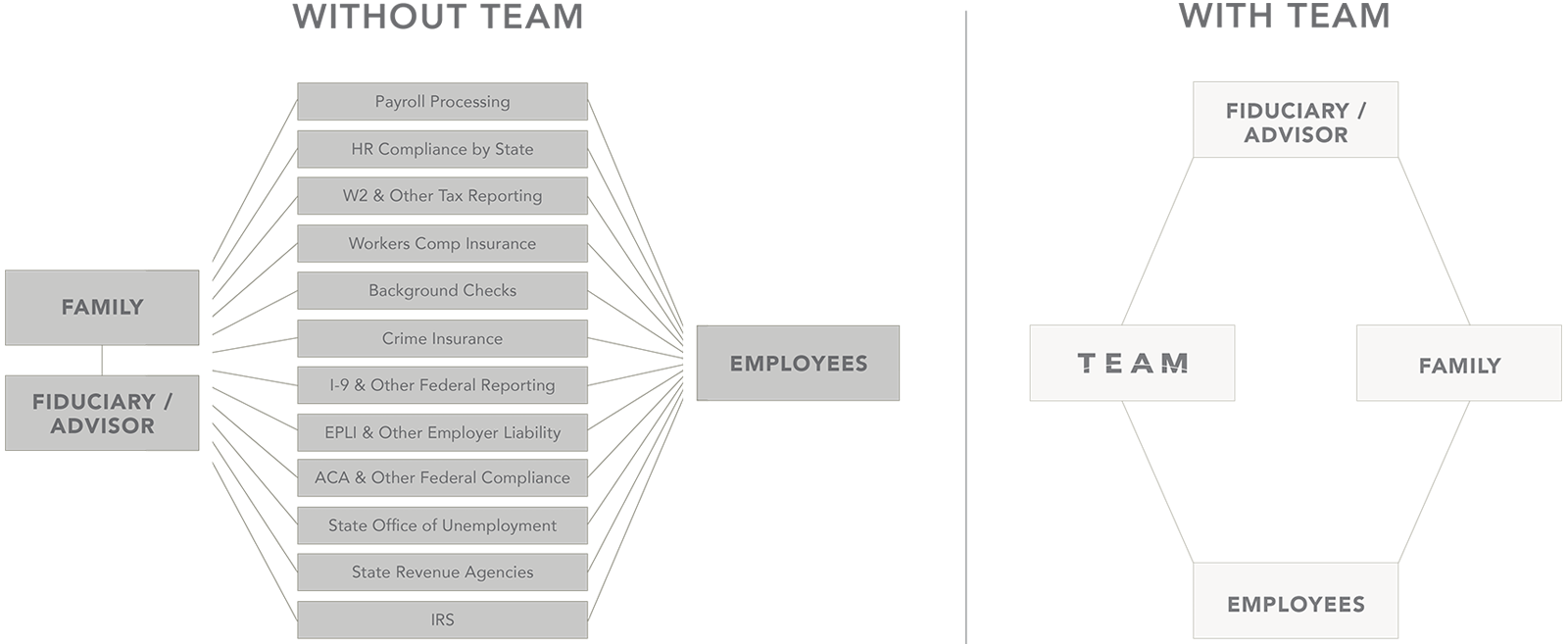

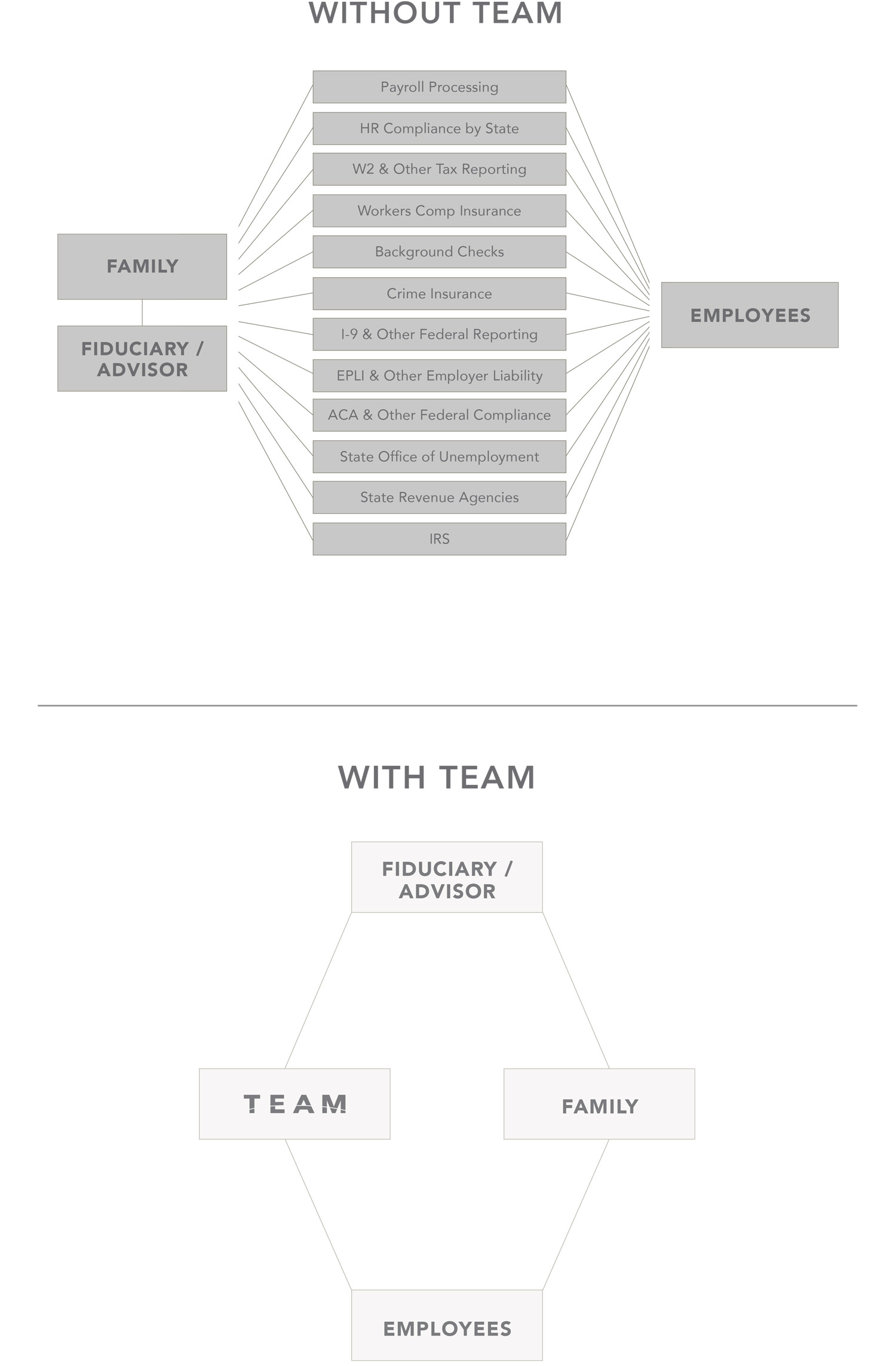

A payroll service provider is responsible for handling payroll processing and administration. While this alleviates some of the administrative burden for employers, payroll companies are not responsible for compliance with employment laws, or the accompanying human resources duties. It also leaves the employer exposed to potential claims and lawsuits. Unlike a payroll company, TEAM becomes the administrative employer of record. TEAM’s service includes human resources consulting, claims management, and more. As the employer of record, TEAM provides a liability shield for the client, trust, and/or fiduciary, protecting them from employment-related claims and lawsuits. This is a key differentiator for TEAM and one of the reasons that many financial institutions choose to work with us.

TEAM has a national presence and serves clients in all 50 states as well as Washington DC, Puerto Rico, and Guam. We do not contract out our services to third-party agencies.

Once TEAM receives the employee’s completed enrollment packet and other account forms or requirements, it typically takes three to five business days to complete the onboarding process and begin services.

Yes. TEAM clients and employees have 24/7 access to payroll records and paystubs, which include line items for gross and net pay, taxes, etc.

Yes. We prepare, file, and remit federal, state, and local taxes under TEAM's EIN.